- The World Bank Group’s International Finance Corporation (IFC) has spent millions of dollars and over three years assessing the harms caused by its support for coal power development in the Philippines, following a damning compliance investigation in 2021.

- But an IFC report published quietly today indicates that it will not take any action to address those harms, which include forced displacement, violence and intimidation against community activists, respiratory disease and other health and environmental impacts, and the exacerbation of the global climate crisis.

- IFC is also refusing to publicly disclose the findings and recommendations of its assessment, leading complainants to accuse it of “covering up” the harms and its role in them, along with the recommendations it commissioned to address them.

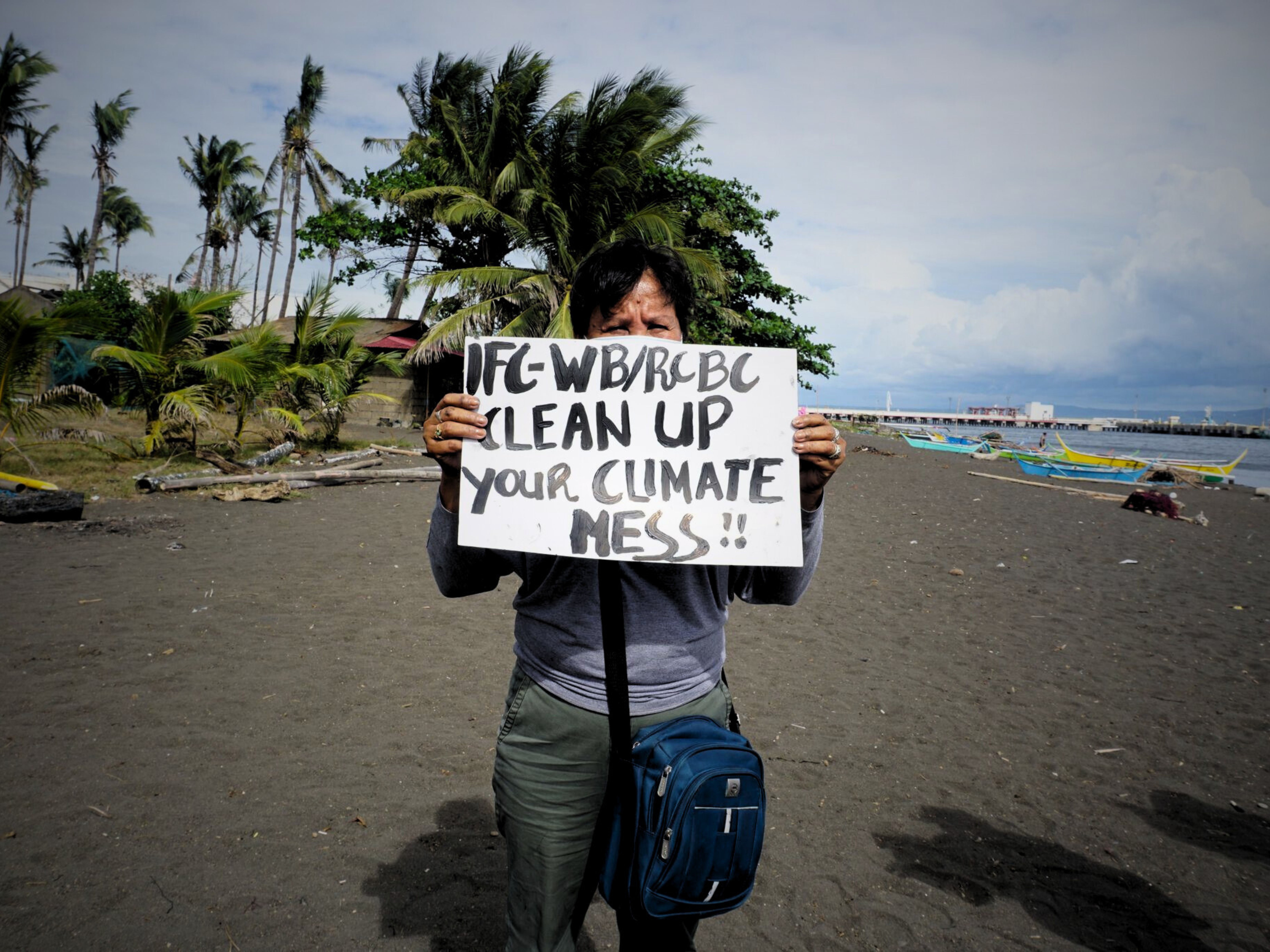

- Affected communities and human rights NGOs argue that inaction represents a huge moral failure and a reputational risk for the World Bank Group, given the IFC’s commitment to remediate harms it has contributed to through its financing, and are calling for the World Bank Group to directly address the adverse impacts of its investments in RCBC.

(MANILA, Philippines – January 21, 2025) – Communities and rights organizations involved in an ongoing complaint against the International Finance Corporation (IFC), the World Bank’s private sector arm, accuse the multilateral development bank of covering up the harms caused by its support for the construction of 10 coal-fired power plants in the Philippines. This follows today’s publication of a progress report by the IFC indicating that it will not disclose the findings and recommendations of its years-long and multi-million dollar assessment of those harms, and that it has no plans to take action to remedy them.

“We are angered by IFC’s resistance and unwillingness to disclose the assessment reports. Affected communities remain unheard and invisible. We are kept in the dark at a time when we are beset with the disastrous impacts of coal plant operations. We face an uphill battle in realizing remedial actions as IFC continues to evade responsibility. We cannot allow the bank to walk away with all the death and destruction it caused to people and planet. It should not be allowed to do business at the expense of our health, environment and future. We have endured long enough. It is time for IFC to pay – no ifs, no buts!” Aaron Pedrosa, Head of Legal Team, Philippine Movement for Climate Justice

“We are extremely disappointed that the IFC is abandoning its responsibility for financing the coal plants in our communities. This is an insult to all of us who have been fighting for seven years to protect our rights and expose the harm done by these plants to our lives, livelihoods, and environment. The negative impacts of the climate crisis continue to get worse at the global scale and in our community in Bataan. We cannot accept the IFC’s decision because its role is clear in enabling our worse conditions through the continued operations of these plants.” Derek Cabe, Nuclear-Free Bataan Movement (a member organization of the PMCJ)

Between 2011 and 2017, Rizal Commercial Banking Corporation (RCBC), a financial intermediary client of the IFC, financed dozens of new coal fired power plants across the Philippines, in violation of IFC’s social and environmental Performance Standards. This occurred while IFC held a 13% equity stake in the bank and a seat on its board of directors. In 2021, the IFC’s own Compliance Advisor Ombudsman (CAO) concluded, in response to a complaint from project-affected communities and non-governmental organizations, that the IFC had contributed to environmental, social and climate-related harms caused by ten of these power plants, and that it should contribute to remediating the harms.

Yet after spending three years and millions of dollars on a Board-approved Management Action Plan (MAP) that included commissioning third-party assessments of each of the ten coal plants, the IFC’s progress report does not propose any path forward to bring the coal plants into compliance and alleviate the suffering of affected communities. The IFC points to RCBC’s disagreement with the consultant’s findings and recommendations, which confirmed most of CAO’s findings in minute detail. IFC has so far declined to discuss the consultant’s findings and recommendations with the coal plant operators directly, despite having active financial relationships with some of the companies.

The IFC also refuses to disclose the third party assessments, either publicly or to the Complainants who contributed to them, citing RCBC’s opposition to any such disclosure. Rights groups are calling this an attempt to cover up and avoid accountability for the disastrous impacts of its investment in RCBC.

“This case encapsulates the risky nature of financial intermediary lending, whereby a publicly-funded bank hands power over to profit-driven private banks, with catastrophic outcomes for people and the environment. It is a disgrace that the IFC is trying to wash its hands of responsibility for the climate-busting coal boom in the Philippines. The local communities can’t wash away the coal dust nearly as easily.” Daniel Willis, finance campaigner, Recourse.

In response, the Philippine Movement for Climate Justice, Recourse and Inclusive Development International–which filed the complaint on behalf of affected communities that precipitated the CAO investigation–are calling for the World Bank Group to step in and directly address the adverse impacts of its investments in RCBC. The complainants have called on the public and private sector arms of the World Bank Group to work directly with the coal plant owners, and in partnership with the Philippines government, to mitigate the environmental impacts of the 10 coal plants, treat the medical conditions suffered by front-line communities, ensure safe drinking water, restore the livelihoods of fisherfolk and farmers, and end reprisals against community representatives.

“The fact is the World Bank Group has profited for thirteen years from its ill-conceived investments in RCBC and the coal bonanza that it financed with the Bank’s capital, so its shareholders have a moral obligation now to clean up their mess. The Board should instruct both the public and private arms of the Bank to use all of the levers, relationships and resources they have at their disposal to implement the remedial recommendations made by the assessments that they funded. This could include working directly with the coal plant owners to reduce harmful emissions and working with the Philippines government to design and fund health and livelihood programs that address the needs of coal-affected communities.” David Pred, Executive Director, Inclusive Development International

Along with the IFC progress report, the CAO has today published its own monitoring report on the implementation of IFC’s Management Action Plan. The CAO reports that “IFC has made significant efforts to assess the E&S risks and impacts of the 10 power plants. However, the risks and impacts to communities and the environment identified have not been mitigated, despite IFC’s E&S consultant making 186 recommendations to improve power plant E&S performance and/or address underlying complaint issues.” The CAO noted that IFC’s progress report highlighted 72 recommendations as actions that could be undertaken or initiated with relative ease compared to others, and in some cases, do not require involvement of the power plant operator.

The CAO also noted that IFC has been unable to assess GHG emissions from the power plants, which it committed to do under its action plan. The Ombudsman observed: “Unless additional action is taken, they will likely emit significant GHG emissions for decades to come, adding to climate change and presenting a lost opportunity to enhance their energy efficiency.”

Further information

- Between 2011 and 2015, IFC made five equity and debt investments in Rizal Commercial Banking Corporation, amounting to USD 228 million. After receiving IFC’s investments, RCBC went on to provide and arrange billions of dollars in financing for 19 coal-fired power plants across the Philippines.

- In October 2017, the Philippine Movement for Climate Justice, supported by human rights NGOs Inclusive Development International and Recourse, submitted a complaint to the IFC’s Compliance Advisor Ombudsman (CAO), accusing the IFC of fueling global climate change and causing widespread environmental and social harms in the Philippines as a result of these investments. The complainants argued that RCBC’s financing of the coal plants was not in compliance with the IFC’s social and environmental Performance Standards and that IFC had breached its own Sustainability Policy by failing to enforce the standards.

- In 2022, the CAO published a compliance investigation report in response to the complaint, which concluded that IFC’s failure to ensure that RCBC applied the Performance Standards to the financing of these plants very likely caused serious harm to surrounding communities.

- The coal plants affected the livelihoods, health and well-being of affected communities due to air and water pollution and physical and economic displacement, among other harms. Local community activists who opposed the projects faced reprisals from the project developers, with one prominent environmental and human rights defender Gloria Capitan being murdered on July 1, 2016.

- The CAO report also notes that, once operational, the plants will produce approximately 40 million tons of CO2 annually–roughly 30% of the Philippines’ annual emissions in 2019–exacerbating a global climate crisis to which the Philippines is acutely vulnerable.

- The CAO called on IFC to provide remedy for these impacts and to reform its financial intermediary lending practices to prevent future harm.

- The IFC responded to the CAO report with a Management Action Plan (MAP) detailing how it would address CAO’s findings and recommendations. This was the first MAP to be adopted by the IFC’s Board of Directors under the new CAO Policy (2020).

- In the MAP, IFC committed to “assess” and “mitigate” the non-compliance-related impacts of the 10 coal subprojects (pp.37-42).

- IFC retained a third-party firm, Environmental Resources Management (ERM), to undertake multiple studies on the 10 coal subprojects and on RCBC’s wider portfolio of high-risk projects and make recommendations to bring these projects into compliance with the Performance Standards. As summarized in IFC’s progress report released today, ERM’s “gap analysis” assessment of the 10 coal subprojects found that 43 of the 70 issues raised by Complainants could be “attributed” or “likely attributed” to the power plants (many of which are associated with considerable harm to local communities). The consulting firm made 186 recommendations to address these issues.

- The Complainants were deeply involved in supporting ERM to undertake the assessments, including facilitating access to the affected communities and reviewing and commenting on drafts of the reports.

- According to the IFC report, RCBC disagrees with the findings and recommendations of the gap analysis reports, and as a result it discontinued its initial sharing of the reports with its clients including the power plant operators.

- According to the CAO monitoring report, the IFC “does not provide a path forward for resolution of these serious and pressing issues,” despite its commitment under the MAP approved by the Board to “assess and mitigate E&S risks and impacts of complaint sub-projects.” Unless further action is taken, the CAO concludes that “the environmental and social impacts associated with the operation of the power plant sub-projects financed by IFC will remain largely unmitigated.” (p. 16)

- Citing client confidentiality agreements and unspecified data privacy laws, IFC refuses to disclose the final gap analysis reports to the Complainants, even though the draft executive summaries were shared with them for their comments. The CAO has called upon IFC to at least share the reports with the Complainants, noting that they are a “major output of the MAP and were prepared using primarily public environmental information and consultation.” (p. 16)

- This case is particularly pertinent in the context of IFC’s proposed Remedial Action Framework, which has been under discussion now for over two years and awaiting final approval by the Board.